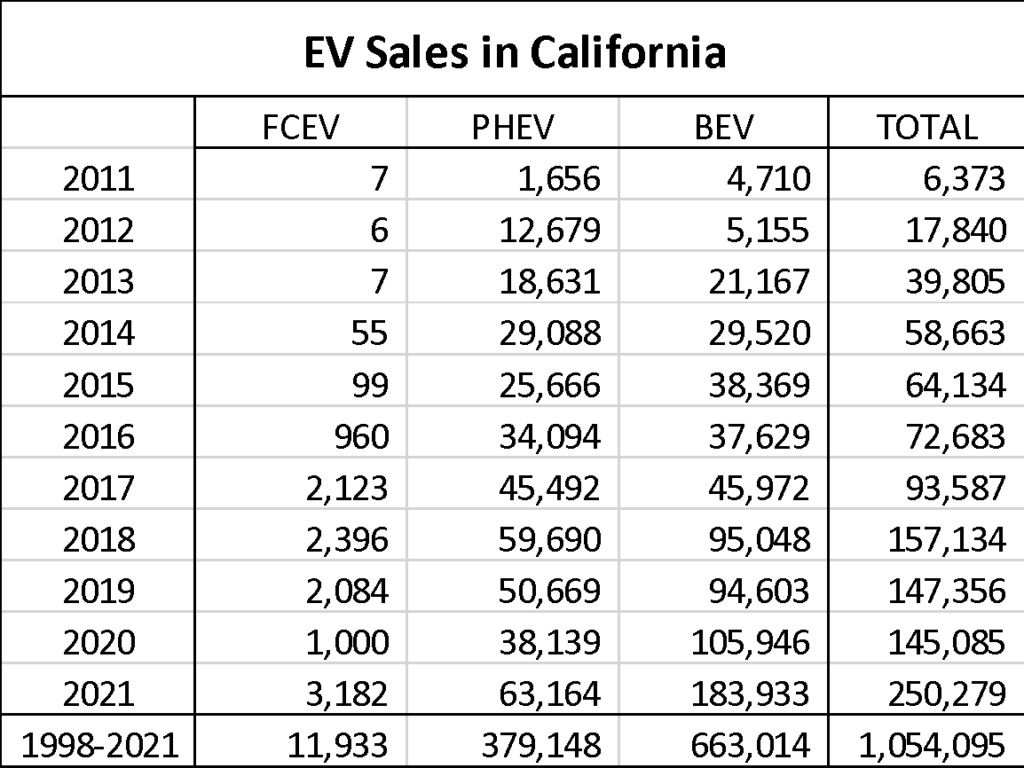

California EV Sales Top a Quarter Million in 2021

Based on the data just released from the CEC, sales of zero emissions vehicles (ZEV) in the state grew 73% in 2021 vs 2020, a new record. Some of this surge was probably due to pent-up demand during the lockdown. This surge in 2021 pushed the cumulative total sales over 1 million vehicles (1,054,095). ZEV sales in California are now over 13% of all new light duty vehicle sales (approx. 1.9 million in 2021). The ZEV leader is clearly the battery electric vehicle with 73% of 2021 sales and 66% of cumulative sales since 1998. Plug-in Hybrid vehicles lost out to BEVs in 2014 and have never regained the lead. Fuel Cell EVs are now under a 1.5% share of all EVs in the state, down from a peak of 2.2% in 2017. The cumulative total of FCEVs now stands at 11,933 or a little more than 1% of all EVs sold in the state. The 2021 sales of FCEVs were boosted not only with the reduction in lockdown restrictions but also by the $15,000 prepaid fuel incentive (about 7 years of fuel) provided by Toyota to buyers of its Mirai sedan. As a result, the Mirai ended up capturing 73% of all FCEV sales in the state last year.

California Energy Commission Zero Emission Vehicle and Infrastructure Statistics. Data last updated Dec. 31, 2021.

Entering the scene for the first time in 2021 were sales of the Rivian truck—264 sold in the state, mostly in L. A., Orange County, and Santa Clara County.

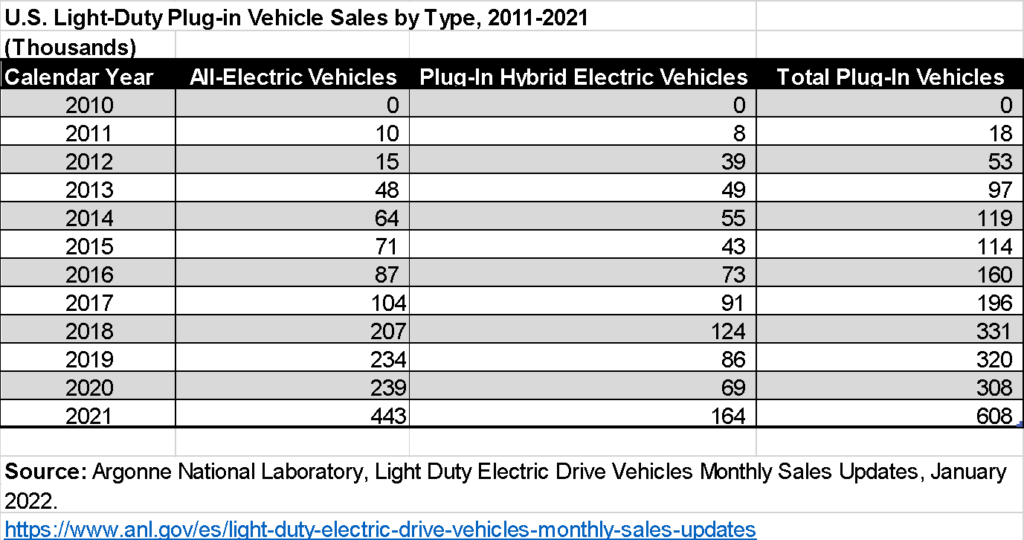

There was an even larger 97% surge in sales of EVs nationwide in 2021 over 2020, according to data from DOE’s Argonne National Lab. If these data are on a similar basis as the CEC data, then California EV sales represent 41% of all EV sales nationwide.

Most of these sales are still Teslas. The Model 3 and Model Y each outsold the next top 5 EVs models. This makes 2022 an exciting year. Surging gas prices, over 20 new EVs from legacy OEMs, and the arrival of electric work trucks and vans exponential present an opportunity to change the landscape. In our predictions we optimistically said 10% of all new vehicles will be ZEV, hopefully we nail it.

ABOUT THE AUTHOR

Thomas is the Executive Director of CleanStart. Thomas has a strong background in supporting small businesses, leadership, financial management and is proficient in working with nonprofits. He has a BS in Finance and a BA in Economics from California State University, Chico. Thomas has a passion for sustainability and a commitment to supporting non-profits in the region.

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

CleanStart Sponsors

Weintraub | Tobin, Moss Adams GreenbergTraurig

BlueTech Valley, PowerSoft.biz, Revrnt, Synbyo, Momentum

College of Engineering & Computer Science at Sacramento State

“Virtual” Power Plants Have Big Role to Play

As the thinking about the power grid of the future continues to evolve, there is no topic hotter than how best to use assets owned by customers and spread over the entire network in the thousands. Coordinating, controlling, and making these resources reliable enough to use them to meet an increasing share of power needs are now the focus of many startups and established players alike. The industry talks about these as Distributed Energy Resource Managements Systems (DERMS), Virtual Power Plants (VPPs) and Microgrids (MG). Technology is rapidly blurring the distinctions among these terms. Whatever it is called, the idea is blending solar panels, batteries, controllable thermostats, refrigerators and backup generators into a system not designed for this purpose without a big problem, while saving everyone money. It could involve centralized control or, even better, using AI-based learning to create a self-managing, self-healing system. Lots of room for innovation. It’s a big challenge, with a big upside for those who can rise to meet it.

At our February 24 MeetUp, we had presentations from SMUD and solar pioneer SunRun on how they are addressing this challenge locally. A recording of the event is available HERE.

Jillian Rich, a strategic business planner at SMUD, explained that SMUD is already wading into this challenge with a load flexibility portfolio, creating new VPPs, and announcing new incentives for battery storage. SMUD calls this program “My Energy Optimizer” and they will roll it out in stages. The first involves placing controllable thermostats in customer homes using Uplight, a Boulder, CO, company with 400 employees that helps 80 utilities nationwide to implement these types of programs. Participating customer will receive incentives to allow the utility to increase the temperature in their homes for a few minutes and not more than 50 times per year to shed load on command. In the second stage which was just announced, SMUD will provide cash incentives for customers to help support the grid. There will be three levels of participation. “Starter” participants will receive $500 to use their stored energy to replace grid-delivered power at times of high prices. “Partner” participants will get $1,500 to get all the “Starter” benefits, plus let SMUD use their batteries to reduce the power draw of the home when the grid is stressed. “Partner-Plus” participants will get $2,500 and all the “Starter” benefits plus will allow SMUD to make them part of a VPP aggregate to share their battery with other customers, achieving a larger localized help to SMUD. In the third stage expected by 2024, SMUD will be looking for ways to involve EV chargers to provide 2-way power flow and use car batteries as part of the stored energy resource for the grid.

Success for SMUD will come if it can count on about these customer resources to provide about 5% (estimating off her graph) of the capacity needed to balance the system by 2030.

Carl Lenox, SunRun Senior Director for Electrification and Advanced Products, noted that his company sees a huge growth opportunity in this area. Founded in 2007, SunRun is active in 22 states plus DC, with 360,000 residential customers. It has been aggregating customer resources since at least 2019 when it conducted a case study paid for by DOE of about 10,000 customers in New England that they managed and created a capacity resource available to the regional ISO. New England was one of the first regions to try to use an aggregator-intermediary to create resources to support the grid, starting in the 1990s. Those early efforts exposed how difficult it was to use these “behind-the-meter” resources to provide capacity the grid could rely upon. Much has been learned since, and now the results are better.

Carl also noted that SunRun wants to have a premier spot in V2G technology, starting with its recently announced arrangement with Ford to provide this technology to couple the F-150 Lightning e-truck to the home. Ford has gotten 150,000 pre-orders in just three weeks. The vehicle first could provide backup to the home with a 130 kWh capacity battery pack that could transfer as much as 9.6 kW at a time, enough to run and entire home. SunRun will start with Vehicle to Home (V2H) technology, initially for backup and then as a way to manage use to reduce a homeowner’s power bill. This will give them a foothold to move to full V2G with more experience.

With billions of dollars pouring into companies offering new technology in this area, it is one ripe for clever innovators to apply their creativity.

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

CleanStart Sponsors

Weintraub | Tobin, BlueTech Valley, Revrnt,

Moss Adams, PowerSoft.biz, Greenberg Traurig, Momentum,

College of Engineering & Computer Science at Sacramento State

West Biofuels Making the Leap to Commercial Plants

After more than 15 years of R&D, West Biofuels (WBF) in Woodland is building its first two commercial scale plants to convert agricultural and forestry residues into electricity. It has plans to develop many more as these first two prove their commercial viability and as they widen the number of valuable products they could produce. We recently sat down with COO Dr. Matt Summers to get the details on what has been happening.

WBF has been getting increased attention because of its focus on conversion of forestry thinnings to valuable energy products. California wildfires of the last half-decade have made the need to manage forest by thinning the underbrush and deal with the damaged timber much more urgent. WBF began with some research and development to build a “process development unit” that would allow them to study various configurations and approaches to deal with a variety of urban, orchard, ag and forest biomass available in California. The original idea was to convert these underutilized resources efficiently into a bio-syngas containing a mixture of hydrogen, carbon monoxide, carbon dioxide, and methane that could fuel a reciprocating engine-generator to make electricity. While that looked simple and achievable on paper, West Biofuels had to adjust their approach due to costs and the marketplace. The prices utilities were willing to pay for power from renewable sources were falling and, as many have encountered, feeding an engine with bio-syngas was hard on the engine requiring high maintenance costs.

Then, two things changed that put WBF on the road to a commercial unit. First, they switched to using a different technology for power production. They now use an indirect-fired power generator—an organic Rankine cycle (ORC) system. In an ORC system, heat generated from the biomass is used to expand an organic working fluid through a turbine and is recondensed to continue the cycle. It is a closed loop system without any waste streams. It can be slightly less efficient than feeding bio-syngas to an internal combustion engine, but the savings in maintenance more than justify the switch.

Second, in a moment of foresight the California Legislature passed the Bioenergy Market Adjusting Tariff (BioMAT) law requiring utilities to pay a very favorable fixed price for electricity derived from biomass in small generators less than 3 MW in size up to an aggregate of 250 MW (Public Utilities Code § 399.20). For the Investor-Owned Utility companies (IOUs), this Feed-In Tariff (FIT) allows a project to enter a fixed contract to become part of the IOU renewable energy portfolio. Electricity generated as part of the BioMAT program counts towards the utilities’ renewable and resource adequacy targets. Small-scale bioenergy projects can be procured in three categories with allocations and prices set by the CPUC:

Table 1. BioMAT Allocation Summary in 2021 as reported in Annual RPS Report by CPUC

|

BioMAT Category |

BioMAT MW Allocation | MW Contracted | MW Remaining | Contract Price ($/MWh) |

|

Biogas from waste |

110 | 10 | 100 | $127.72 |

|

Dairy and agricultural biomass |

90 | 26.5 | 63.5 |

Dairy: $187.72 Other Ag: $183.72 |

| Forest biomass | 50 | 11 | 39 | $199.72 |

| Total | 250 | 47.5 | 202.5 |

These fixed prices are higher than what power from solar and wind farms receive through their current incentives. BioMAT is a is an opportunity to boost these favored forms of biomass-to-energy in California to help establish a more mature marketplace similar to solar and wind.

With these two changes, WBF has moved to market a 3 MW scale biomass-to-electricity within California with a plan to drive down costs over time, add more technology, and open up a wider market. WBF has signed contracts with two entities to build these plants. One is finishing construction in Williams and will use rice hulls as a feedstock. Another is near Burney in Shasta County, with forestry residue feedstock), and is starting construction this spring. The Burney plant also has the option of producing as much as 6,000 tons/year of biochar, used for filtration, as a soil amendment or an asphalt additive as an additional source of revenue. Now WBF is seeking financing and investment to support another half-dozen similar plants while there is still headroom under the 250 MW cap on BioMAT projects.

Knowing that the California BioMAT program will sunset in 2026, WBF is continuing to see what would widen its customer appeal. The research continues and the process development unit has gotten much bigger. The technology push now is to feed the synthesis gas to a catalyst bed to create liquid chemicals and fuels. These products generally have a higher value than electricity outside of the BioMAT market, improving the economics of the process. WBF is looking at two catalyst paths. The first pathway generates an output on mixed alcohols and methane. WBF has found that it can make a product stream that has half the energy in the mixed alcohols and half in the methane product.The alcohols include butanol, n-propanol , and ethanol. All three have good commercial markets, especially the n-propanol which is used as a solvent for inks as in ink-jet printers. The methane product is sent to the utility pipelines as renewable natural gas to be used by industrial, residential and transportation customers in place of fossil natural gas..

The second approach is to produce jet fuel and diesel through a Fischer-Tropsch-type catalyst system. These types of catalysts convert syngas into straight chained hydrocarbons of various densities from light gasses to heavy waxes. For WBF, a portion of the feedstock energy (20-30%) converts directly into jet fuel and diesel. There is a substantial quantity of waxes as well, plus light gases that would go to generate power for the process. The objective of the current WBF research is to figure out how to increase the yield of the jet fuel/diesel fraction and to explore how the waxes could be used in a standard oil refinery to increase the renewable content of motor fuels or lube oils, possibly by using spare Fluidized-bed Catalytic Cracking (FCC) capacity. Adding a renewable feedstock to the refinery would help lower the carbon footprint of the fuel it produces to meet California’s Low Carbon Fuel Standard targets. The vision is for these advanced WBF plants making chemicals and renewable fuel products to be economical beyond the expiration of the BioMAT program.

Matt has always wanted to get to the point where they were building dozens of plants and making a real impact. With these first two plants, he is excited to see that dream starting to become real even though it took fifteen years. Meanwhile, the research and development continues to make the next generation of biomass technologies.

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

CleanStart Sponsors

Weintraub | Tobin, BlueTech Valley, Revrnt,

Moss Adams, PowerSoft.biz, Greenberg Traurig, Momentum,

College of Engineering & Computer Science at Sacramento State