Looking to 2023… Our Predictions

Even for the most studied of clean tech watchers, the business of predicting the future of green technologies is hard work. In 2022, Clean Start Chairman Gary Simon and Executive Director Thomas Hall put their decades of knowledge to work … with mixed results. In this round-up, they are back at the business of sharing their informed take on the future on all things clean tech. The world took notice of the milestone step towards fusion power, but Gary reveals the next big step towards a seemingly endless source of clean power. And while YouTubers can’t stop fawning over the electric vehicle startups like Rivian, Polestar, and Lucia, Thomas makes a bold prediction about the fate of the EV startups. Will these predictions prove accurate? Let’s debate in the comments but only time will tell.

There will be no Level 3 Energy Emergency Alerts in California this year.

This alert level is the last step before starting rotating blackouts to preserve the grid. We had one at this level on September 6, but avoided the rotating blackouts. It’s pretty bold to say we won’t have another in the coming year because It depends on so many random factors—generator outages, extreme heat, transmission line failures, accidents, and the like. But we believe the grid is more resilient now and can withstand these random events.

Lithium prices will decline and finish the year below $40,000 per MT.

Lithium carbonate skyrocketed to $75,000 per MT at the end of 2022 (see Chart 3 here). That ten-fold price increase since 2020 was causing many to question the viability of the EV sales forecasts. However, we see many projects to create more supply and to decrease the amount of lithium needed per battery. The result will be a decline in prices, but not all the way back to levels of $5,000/MT from a decade ago. We believe the decline will continue into 2024, but one fearless prediction at a time.

Private, pulsed-fusion company Helion will announce reaching significant milestones.

The announcement out of Livermore National Lab about “better than breakeven” (actually, the experiment returned only 1% of the energy required to fire the lasers) from the huge 192-laser government-funded multi-billion-dollar National Ignition Facility got a lot of attention. But a little-noticed privately-financed effort may be making even more progress. It avoids trying to achieve a stable “micro-sun” ball of plasma (like all the tokamak variations) which may involve insurmountable physics challenges. Instead, it relies on rapid repetitive laser-induced pulses which look easier to control. It fuses deuterium and helium-3 and doesn’t make radioactive products. Second, it involves direct conversion of the produced energy to electricity rather than converting the energy to heat and using that to boil water. The direct conversion is possible because the products of the reaction are charged ions that can be collected, rather than slowing down fast-moving neutrons that have no charge (but create radioactive wastes). Helion has raised $500 million to build a larger scale demo to start operations 2024. The metric is whether it achieves the interim milestones in 2023 that will result in investors putting in more money up to the $2 billion they promised. There is another contender pursuing a similar approach (rapid laser pulses and direct DC conversion), but trying to harness hydrogen-boron 11 fusion, based in Australia. This company (HB11 Energy) is also worth watching. It’s Big Science vs. The Little Guys. Our bet is on the underdogs, with their showing some significant gains in 2023.

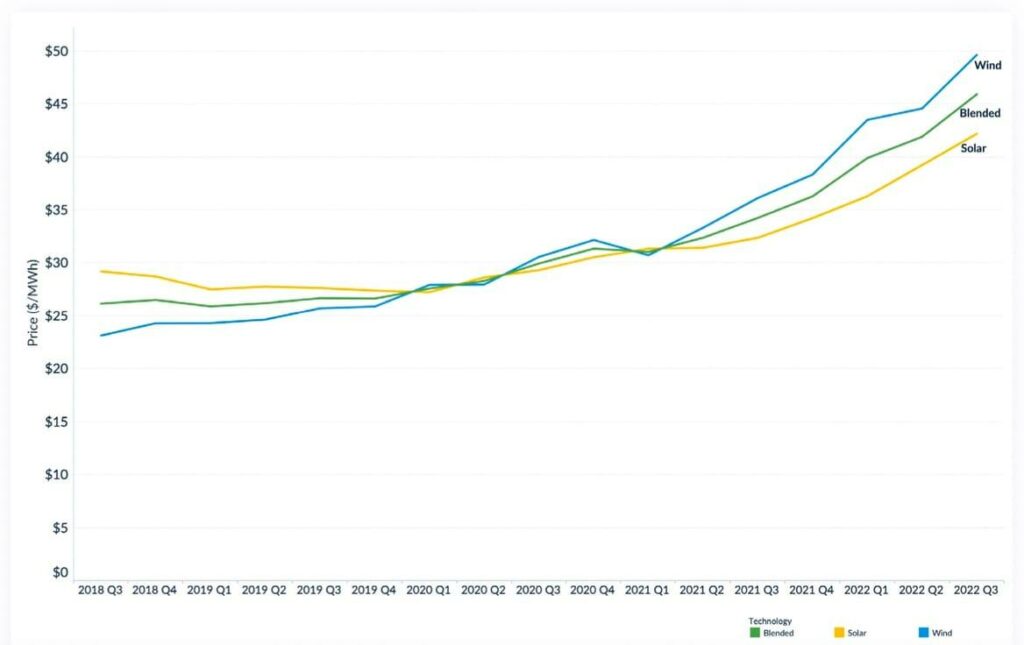

Power Purchase Agreement pricing on average for either solar or wind will not exceed $50/MWh.

PPA prices for utility scale projects have been on a steep rise since the beginning of 2019. Wind has gone from $24.60 to $48/MWh in 3Q2022 according to surveys by Level Ten Energy, and solar has increased from $27.90 to $42.21/ MWh. These big jumps started in about 3Q2021, and were attributed to congestion in the interconnection queues, increased component pricing during the pandemic, and higher labor rates due to inflation. We think those problems are now “baked in” and the steep rises won’t continue. We expect the prices to rise more slowly by the end of 2023, and maybe even drop a little.

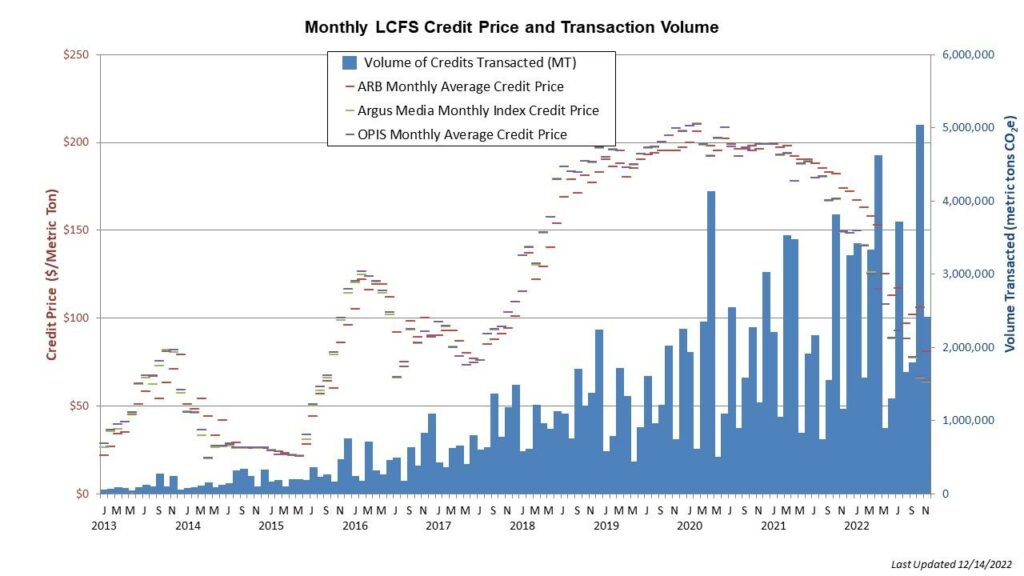

Low Carbon Fuel Standard credit prices will increase but stay below $70 for the year.

These credits are providing strong economic incentives to use non-petroleum fuels and as a result subsidizing the producers of such fuels. In the summer of 2020, the credit prices reached a peak of about $210 per metric ton of fossil CO2 (equivalent) avoided. They have now declined to about $60. These are much higher prices than the carbon allowances from the cap-and-trade program which finished the year around $30 per MT CO2 equivalent, and are creating a powerful incentive to produce alternate fuels. We expect the prices for LCFS credits to go up because each year CARB ratchets down the fuel carbon intensity target, increasing the need for credits and at the same time reducing the quantity. Prices come down when the new supply of alternate fuels exceeds demand. We think we see the supply expanding, so predict that the LCFS credit price will increase only moderately. We have covered how LCFS are driveing emission reductions in California.

Fewer than 10,000 Level 2 Charging Stations will be installed in 2023 in California.

California will struggle to reach its charging station goals. The growth of public and shared charging has been anemic. In January 2021 California had 70,000 public and shared chargers and had 123,000 planned. Of those almost, 6,000 installed and 3,600 planned are DC fast charges. Now, two years later, the state has over 8,500 DC fast chargers and 80,000 total stations. Where are all the level two charging stations we have been predicting? The Cost of Level 2 is too high and most of it is not hardware. To reach California’s 2025 goal of 250,000 stations the CEC has committed to spending $2.9 billion, hoping it will spur 90,000 new EV chargers. $900 Million (plus ~$384M from NEVI) for light duty EV Charging. That works out to about ~$14,000 a charger. Hopefully that will cover it. But for the next year, we predict people fighting over parking spaces and property managers not wanting a headache will hamper California’s goal. (We hope we are wrong.)

Two EV startup companies will be acquired, one by a non-OEM.

In the past two years, there has been an ensemble of Electric Vehicle Manufactures going public on the New York and NASDAQ exchanges. Capital was cheap and everyone wanted to duplicate Tesla’s Stock success. Becoming public was a great option to raise billions needed to deliver EVs. Things have changed but the EV transition is still full steam ahead. Many new EV companies are trading down 80-90%. Being a public company now opens them up to something new. Being acquired. There are several Incumbent OEMs that are behind on the EV transition. Toyota, Mercedes, BMW, Honda, etc. All of the new publicly traded EV companies (with US or European HQs) are now targets for acquisition. And it is not just companies making consumer cars. Both Amazon and Walmart entered into exclusives for delivery vehicles form Rivian and Canoo, whose market cap has been cut in half the last 6 months. Buying a company critical to their distribution at a discount will look very appealing. Small vehicle companies like Arrival SA and Electra Meccanica Vehicles Corp. might be appealing to OEMs like Honda and BMW. With their stock falling and capital cost rising, most of these companies should be eager to accept. Two of the following:

|

Companies that may be acquired |

% from 52 week high |

Approx market cap ($) |

|

Arrival SA |

-97.84% |

<150M |

|

Electra Meccanica Vehicles Corp |

-74.70% |

70M |

|

Polestar |

-60.03% |

11B |

|

Rivian |

-83.84% |

17B |

|

Lucid Group Inc. |

-87.01% |

11B |

|

Fisker Inc |

-62.09% |

2B |

|

Faraday Future Intelligent Electric Inc |

-96.43% |

<150M |

|

Canoo Inc |

-85.04% |

<500M |

|

Nikola Corp |

-81.97% |

1B |

The Sacramento Region will attract a net zero fuel investment >$50 Million.

With the IRA and infrastructure bills, there will be a push for projects that could deliver economies of scale in hydrogen and net zero fuels. With our region’s success with companies and advocacy groups there is a strong possibility of increased investment right here. Sierra Northern Railway has a hydrogen station going in and a hydrogen locomotive, Infinium is doing large projects around the world but operating right here, the California Fuel Cell Partnership has gone international. We believe we will attract enormous investment locally.

Amazon Delivery Vans

By the end of 2022, Rivian finally released more than 1,000 custom electric delivery vans for Amazon. As a startup company, Rivian is looking at major demands from Amazon with their order of 100,000 electric vans by 2030. Rivian will need to make approximately 10,000 vans per year. We believe Rivian still has many obstacles to overcome in such a short time as a new company. They will fall short in 2023, making approximately 4,000 – 6,000 electric vans.

Installed storage capacity in the US will double.

According to Wood Mackenzie, by the end of 2022, the installed capacity of energy storage projects in the US totalled 13.4 GWh, including grid-scale installations and customer-owned projects. In Q3 alone new installations were 4,733 MWh for grid-scale storage and 401 MWh for residential storage projects. We believe that this total capacity will double over the next year, which is less than many analysts forecast. They believe that installations will top 30.3 GWh. We foresee battery production bottlenecks that will restrict the growth.

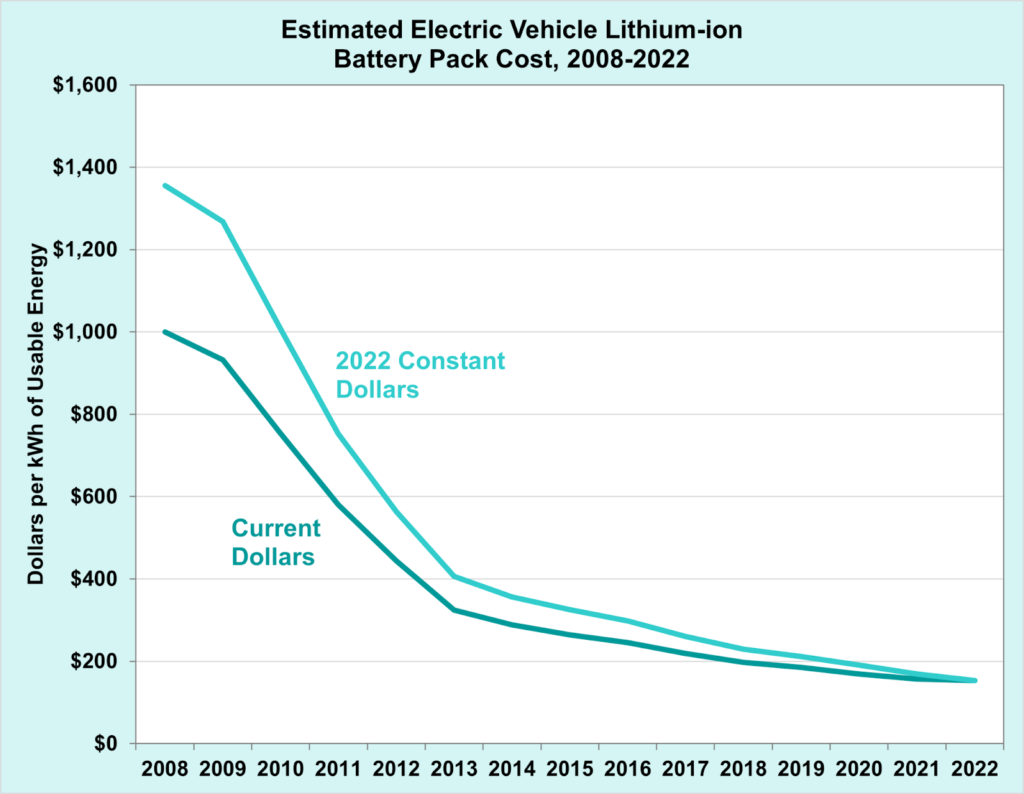

The cost of an electric vehicle battery pack will fall below $140/kWh.

Even in the face of dramatically higher lithium carbonate prices, the prices for a full battery pack have been declining. The Department of Energy’s (DOE’s) Vehicle Technologies Office estimates the cost of an electric vehicle lithium-ion battery pack in 2022 was $153/kWh on a usable-energy basis for production at scale of at least 100,000 units per year. That compares to $1,355/kWh in 2008, a remarkable drop. The decline has been slowing, but we think it will drop another 10% in 2023.

Source: U.S. DOE, Vehicle Technologies Office, using Argonne National Laboratory’s BatPaC: Battery Manufacturing Cost Estimation Tool.

Let’s hope for a great year!

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

Thomas is the Executive Director of CleanStart. Thomas has a strong background in supporting small businesses, leadership, financial management and is proficient in working with nonprofits. He has a BS in Finance and a BA in Economics from California State University, Chico. Thomas has a passion for sustainability and a commitment to supporting non-profits in the region.

CleanStart Sponsors

Weintraub | Tobin, BlueTech Valley, Revrnt, River City Bank

Moss Adams, PowerSoft.biz, Greenberg Traurig, California Mobility Center

Destination Decarbonization: Student Contest with Real Prizes

Are you an undergraduate college student and want a shot at several thousand dollars in prize money? Consider entering the 90-day Destination Decarbonization Challenge! Sam Fairbanks at the Water and Energy Technology (WET) Center at Fresno State provided a quick overview of what the challenge is and how to apply. The main point is that the window is now open through January 31. If you want to give it a shot, better move fast. A video of Sam’s presentation is available on our YouTube Channel.

The idea of the challenge is for small teams of 2-4 students to propose ways to eliminate carbon dioxide emissions either from a brand new idea or from an idea on how to improve something that is already happening. Teams can look at anything that broadly will reduce emissions or capture carbon dioxide for beneficial. The teams will work with mentors and other resources the WET Center can help arrange. The payoff comes on April 21 when the teams pitch their ideas to a panel of expert judges.

The top prize is $6,000, with $4,000 for second and $2,000 for third. There is a webinar that provides details on how to apply on January 19 at 5:30 pm. More information is available on the Challenge website.

Check it out!

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

CleanStart Sponsors

Weintraub | Tobin, BlueTech Valley, Revrnt, River City Bank

Moss Adams, PowerSoft.biz, Greenberg Traurig, California Mobility Center

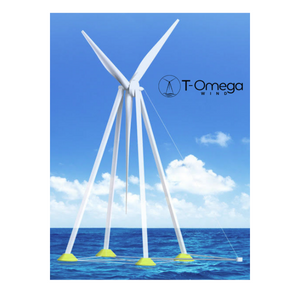

T-Omega May Have the Key to California Offshore Wind

Offshore wind could be the biggest untapped renewable resource for California, and one that provides pretty steady power. The problem in tapping it has been that the best spots are in very deep water (3000 feet and more). Sites like that have been far too expensive to exploit in conventional ways.

On January 5, Brita Formato, CEO of offshore wind innovator T-Omega Wind, and her colleagues CTO Andy Myers and CCO Dave Forbes presented their potential breakthrough in making the 25 GW CEC goal for offshore wind installations a reality. The attraction of the offshore wind resource off the California coast is that it is so steady. It could be a “baseload renewable,” offsetting the problem of intermittency to a large degree. That would add a great deal more certainty to the zero-carbon power mix.

But the traditional kind of floating offshore wind installations have been expensive. To date, the offshore wind installations have been providing power at $85-130/MWh. T-Omega has designed a much simpler and dramatically less costly option for deepwater install-lations, with its four-leg design. It floats, and is loosely tethered to the sea floor, allowing it to survive rough conditions while being lightweight. It is relatively low profile and can be moved if it interferes with fishing grounds unexpectedly. Their projected LCOE is less than half the conventional approach.

But the traditional kind of floating offshore wind installations have been expensive. To date, the offshore wind installations have been providing power at $85-130/MWh. T-Omega has designed a much simpler and dramatically less costly option for deepwater install-lations, with its four-leg design. It floats, and is loosely tethered to the sea floor, allowing it to survive rough conditions while being lightweight. It is relatively low profile and can be moved if it interferes with fishing grounds unexpectedly. Their projected LCOE is less than half the conventional approach.

The typical offshore wind is a heavy floating platform weighing 3-4,000 tons for a 10 MW installation. The T-Omega alternative tips the scale at an estimated 1,000 tons for the same size. That huge savings in steel and concrete translates directly to lower cost.

In addition, T-Omega has made innovations in the type of generator used (a more “pancake” design) and the reduction of the stress on the bearings holding the rotor, accomplished by supporting the rotor at both ends rather than in the middle. Maintenance is simpler, too, with the ability to tow out another unit and retrieve the broken one for a trip back to shore. No need for expensive and difficult on-site repairs. And the port/onshore construction and repair facilities would be much simpler for their modules than for the huge platforms taller than a New York skyscraper.

Brita said they have seen a great deal of interest from developers that won the recent $757 million auction of offshore wind leases in California (with the potential for 4,600 MW of generation), but that the company needs to validate all its projections with a couple of demonstration projects to be considered a viable option. They have recently been awarded an NSF grant to move that work forward. They are also trying to raise $10-12 million for that purpose now. They want to get to a commercial scale unit by 2026.

During the discussion, it was pointed out that getting adequate transmission to move the power into the backbone of the grid may be a big hurdle. To get more than a few hundred MWs tied-in could require a big investment. That problem is being worked on by the CEC, the CPUC, and the utilities, but the pace at which they add transmission may be the bottleneck that slows progress.

T-Omega is sure to gain more attention and we will definitely be inviting them back for an update.

The session is available on our YouTube Channel, if you missed it.

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

CleanStart Sponsors

Weintraub | Tobin, BlueTech Valley, Revrnt, River City Bank

Moss Adams, PowerSoft.biz, Greenberg Traurig, California Mobility Center

Welcome Briana!

We are pleased to share that Briana Trejo has joined CleanStart as our new Marketing Associate!

Briana is a proven leader who has worked within the clean energy industry domain for 4 years. She brings to the CleanStart executive team great passion for sustainability with alternative energy resources. She is a clean tech and electric vehicle enthusiast. Briana has focused her time advocating with nonprofits dedicated to promoting and educating disadvantaged communities of alternative fuel vehicles and government incentives to improve the air quality within the San Joaquin Valley and Bay Area.

We’re excited to welcome her to CleanStart and look forward to her contributions to our efforts to guiding clean technology entrepreneurs and their endeavors.

Follow her on:

Twitter: @britre95 or on LinkedIn