Anyone Getting Rich on Clean Tech Stocks?

The question often comes up whether clean tech is really a good investment for the little guy. There are billions being invested—but what is the result in building wealth for investors? Of course, Elon Musk and a few other individuals have gotten rich. But is the wealth being spread more broadly? One way to answer it is to look at the performance of public clean tech stocks. There is now more than a decade of history to look at.

You can try to follow all the public cleantech stocks, but there are now so many that would be an enormous job. As a better alternative, there are a number of indexes purporting to track clean tech, For some, though, when you look at what stocks are in the index, they don’t seem so clean. You find oil and gas companies, large utilities, big software companies (like Microsoft), and big industrials as well as a smattering of smaller clean tech companies in their list.

However, there is one index that has been doing a pretty good job of focusing on a “pure play” list of what most would consider cleantech companies. CleanEdge, Inc. has created the CELS index, and it is tracked on NASDAQ. It is still a blend of very early-stage public companies with their more mature cousins but stays closer to what one would ordinarily think of as clean tech. Ten years ago there were not many public clean tech stocks. Now CELS follows 62 companies. CleanEdge has also created indexes focused on certain clean tech sectors: HHO for clean water, QGRD for smart grid infrastructure, and GWE for wind energy.

While the CELS index is listed on NASDAQ, you cannot trade on it. To do that, you must look for an exchange-traded fund or ETF that holds the same stocks as CELS. The only one so far is done by First Trust Advisors with the symbol QCLN (First Trust Clean Edge Green Energy Fund). As an investor, the advantage of a managed index such as CELS is that periodically the weakest companies that no longer meet established criteria are dropped and new ones are added. This may not give a good picture of the overall trend in cleantech companies listed on public exchanges, but it is a better way to invest in a portfolio of clean tech companies than trying to manage a basket of stocks yourself.

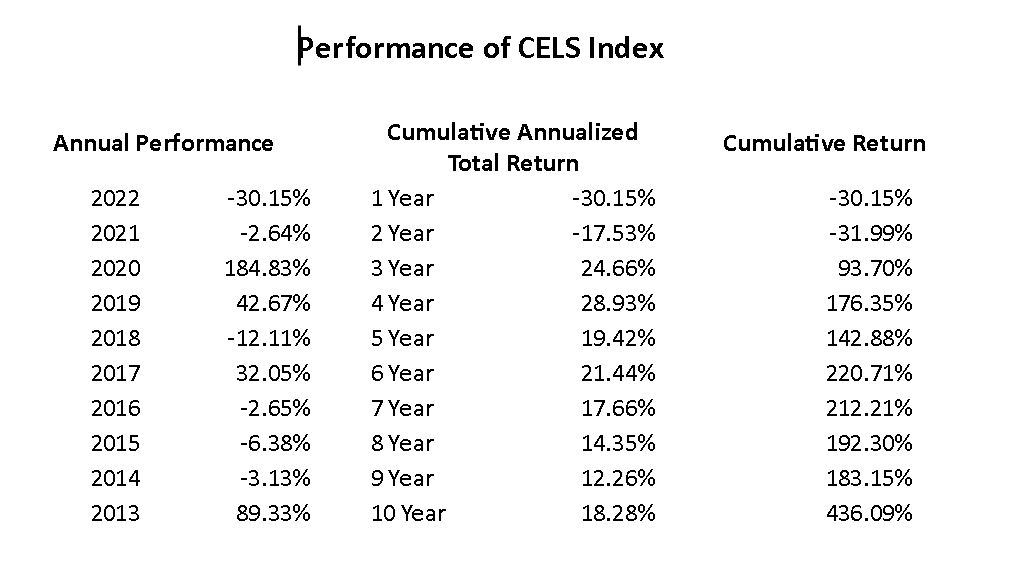

The performance record of CELS has been good in the long term (a dollar invested in 2012 became over $400 today), but a bummer in the last two years. The volatility year-to-year is a bit frightening.

Source:

https://indexes.nasdaqomx.com/docs/FS_CEXX.pdf

In CELS, there are a number of companies that now pay dividends, albeit small ones. The aggregate yield is now 0.28%. Recognizing that investors may be looking for less volatility and more reliable income, NASDAQ and Clean Edge, Inc. recently announced the creation of a new tracking index for such companies, called the Global Green Income Index (GGINC™). It contains several of the dividend-paying stocks in QCLN and adds a related set of companies (real estate trusts, yield, cos, investment trusts) that are cleantech-oriented and focus on income generation. It is a measure of the industry that one can even put together such a fund in clean tech now.

It will probably take a little time for some firms to create an ETF around this new index while some history is accumulated. Watch for that next step. If it occurs, it may open more fixed-income funds to be willing to invest in this way in clean tech, and that may boost share prices as well.

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

CleanStart Sponsors

Weintraub | Tobin, BlueTech Valley, Revrnt, River City Bank

Moss Adams, PowerSoft.biz, Greenberg Traurig, California Mobility Center