To date, nearly $3.4 billion has been appropriated by the Legislature to State agencies to implement Greenhouse Gas reduction programs and projects. Much of this is allocated in the form of various grants. Agencies are inviting proposals from teams and companies to use these funds, you can see some at California Climate Investments homepage. Recently, CleanStart had presenters from California Air Resources Board (CARB), The Grant Farm, and Terzo Power Systems talk about the process and potential of using grants to finance a startup.

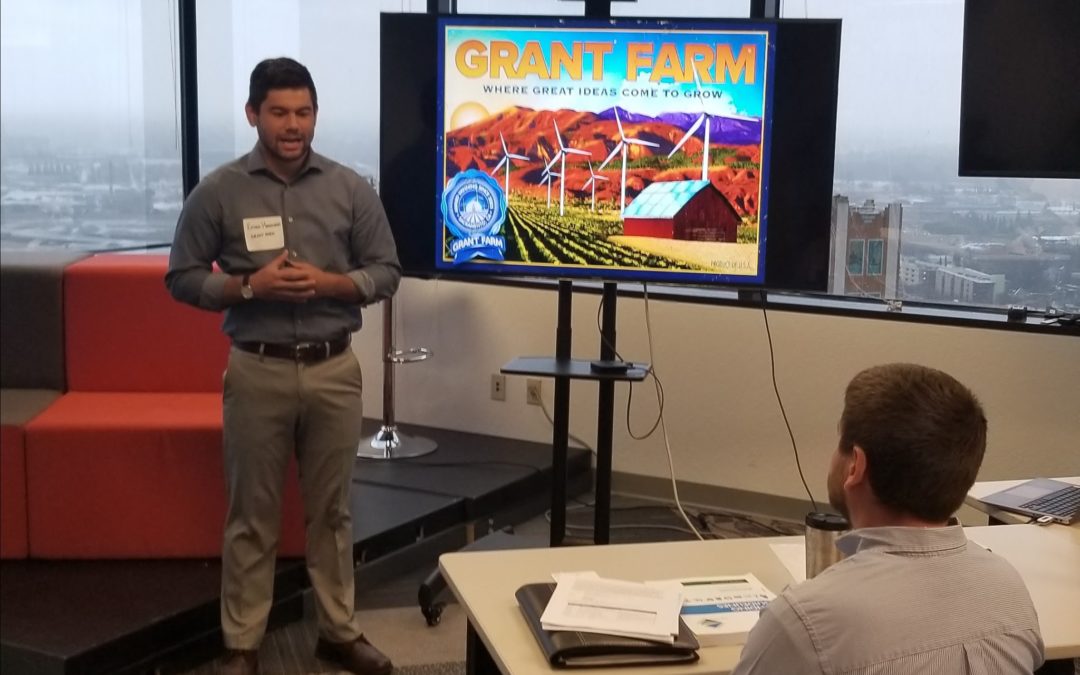

Attendees learned that through AB 32 over $1.6 billion had been allocated to fight global climate change. Ryan Huft, an engineer at CARB, outlined all of the agencies receiving funding available for 2018 and 2019. He shared California Climate Investments as the location of many opportunities. These investments support a variety of state interest but all have common goals: supporting the reduction of greenhouse gases, helping underserved and disadvantaged communities, and helping all of California take the lead in creating a sustainable future. Ethan Hanohano shared his and The Grant Farm’s considerable experience in forming partnerships to win grants and how companies should approach the grants. He recommended starting by building a solid team, creating a purpose, and connecting with grants that are in your companies field.

All the speakers emphasized two things: write exactly what the grant says it wants and connect with disadvantaged communities. Huft’s and Hanohano’s presentations kept going back to one major point, “Grants explicitly lay out what they want. Have your proposal follow that.” There may seem like there is duplication in grants, but everything is there for a reason. So even if you have said it before, say it the same way again. It is important to keep it simple and connect to each requirement.

Connecting with disadvantaged or underserved communities is important and is a good practice for any growing company. Connecting can mean creating jobs, improving quality of life, or connecting a community to more resources. When creating a clean tech or sustainable solution, understanding connections and benefits to communities is not only important for grants but also the general company development. These communities are potentially future customers and partners in new tech development.

Mike Terzo of Terzo Power Systems won $4 million in CEC grants in 2016. He took the application and wrote exactly to it. Terzo is now working on those grants and learning a few extra lessons along the way. The big one was giving yourself time and flexibility to reach milestones and deliverables. Setting a realistic timeline is more important then setting an aggressive one. Realistic time management is important in controlling your business and connecting with investors. With grants it is no exception. Agencies administering the grants have goals they want you to achieve; make sure a proposal has a reasonable timeline for you to do that.

Terzo highlighted understanding a grants reimbursement and your incurred liabilities is important while building a successful grant proposal. Grants pay in arrears, meaning you are reimbursed for costs you have already paid. Vendors, contractors, employees and leases may be due before you receive reimbursement. You will need a way to finance the time difference between incurring the cost, invoicing the agency, and getting a check. It would be common for the grant reimbursement cycle to take 4-5 months. You likely will need a bank, an SBA loan guarantee or alternative financing to make a grant workable for you.

All of the work done for a grant not only benefits a startup if they get the grant, but also pushes them to better understand how their technology connects to the larger ecosystem and how they can be effectively managed. Actively applying for grants can have more benefits than funding for a company.