Even for the most studied of clean tech watchers, the business of predicting the future of green technologies is hard work. In 2022, Clean Start Chairman Gary Simon and Executive Director Thomas Hall put their decades of knowledge to work … with mixed results. In this round-up, they are back at the business of sharing their informed take on the future on all things clean tech. The world took notice of the milestone step towards fusion power, but Gary reveals the next big step towards a seemingly endless source of clean power. And while YouTubers can’t stop fawning over the electric vehicle startups like Rivian, Polestar, and Lucia, Thomas makes a bold prediction about the fate of the EV startups. Will these predictions prove accurate? Let’s debate in the comments but only time will tell.

There will be no Level 3 Energy Emergency Alerts in California this year.

This alert level is the last step before starting rotating blackouts to preserve the grid. We had one at this level on September 6, but avoided the rotating blackouts. It’s pretty bold to say we won’t have another in the coming year because It depends on so many random factors—generator outages, extreme heat, transmission line failures, accidents, and the like. But we believe the grid is more resilient now and can withstand these random events.

Lithium prices will decline and finish the year below $40,000 per MT.

Lithium carbonate skyrocketed to $75,000 per MT at the end of 2022 (see Chart 3 here). That ten-fold price increase since 2020 was causing many to question the viability of the EV sales forecasts. However, we see many projects to create more supply and to decrease the amount of lithium needed per battery. The result will be a decline in prices, but not all the way back to levels of $5,000/MT from a decade ago. We believe the decline will continue into 2024, but one fearless prediction at a time.

Private, pulsed-fusion company Helion will announce reaching significant milestones.

The announcement out of Livermore National Lab about “better than breakeven” (actually, the experiment returned only 1% of the energy required to fire the lasers) from the huge 192-laser government-funded multi-billion-dollar National Ignition Facility got a lot of attention. But a little-noticed privately-financed effort may be making even more progress. It avoids trying to achieve a stable “micro-sun” ball of plasma (like all the tokamak variations) which may involve insurmountable physics challenges. Instead, it relies on rapid repetitive laser-induced pulses which look easier to control. It fuses deuterium and helium-3 and doesn’t make radioactive products. Second, it involves direct conversion of the produced energy to electricity rather than converting the energy to heat and using that to boil water. The direct conversion is possible because the products of the reaction are charged ions that can be collected, rather than slowing down fast-moving neutrons that have no charge (but create radioactive wastes). Helion has raised $500 million to build a larger scale demo to start operations 2024. The metric is whether it achieves the interim milestones in 2023 that will result in investors putting in more money up to the $2 billion they promised. There is another contender pursuing a similar approach (rapid laser pulses and direct DC conversion), but trying to harness hydrogen-boron 11 fusion, based in Australia. This company (HB11 Energy) is also worth watching. It’s Big Science vs. The Little Guys. Our bet is on the underdogs, with their showing some significant gains in 2023.

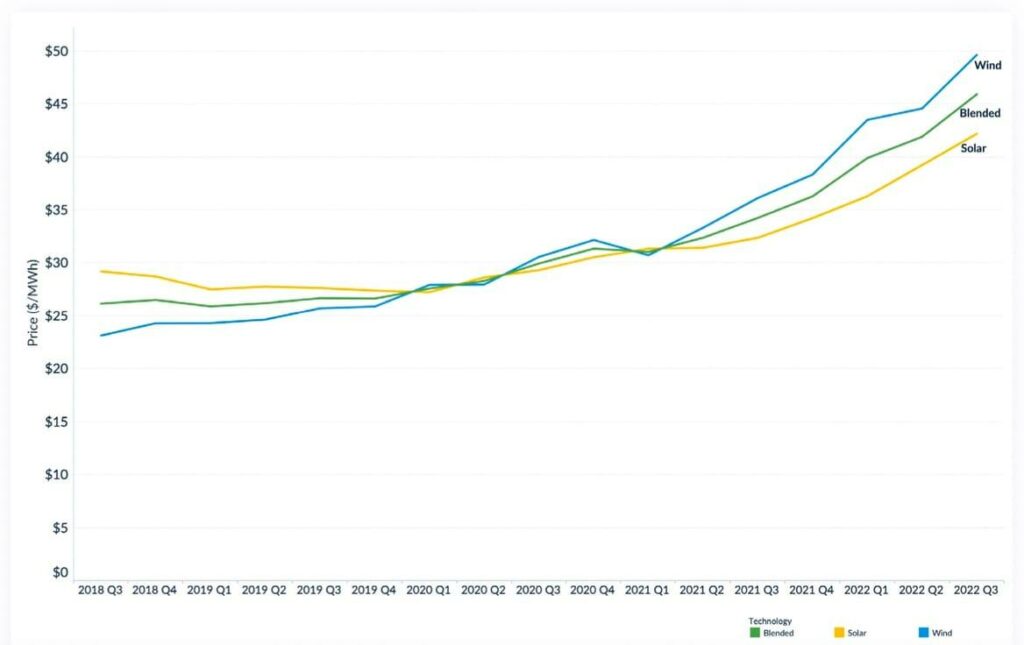

Power Purchase Agreement pricing on average for either solar or wind will not exceed $50/MWh.

PPA prices for utility scale projects have been on a steep rise since the beginning of 2019. Wind has gone from $24.60 to $48/MWh in 3Q2022 according to surveys by Level Ten Energy, and solar has increased from $27.90 to $42.21/ MWh. These big jumps started in about 3Q2021, and were attributed to congestion in the interconnection queues, increased component pricing during the pandemic, and higher labor rates due to inflation. We think those problems are now “baked in” and the steep rises won’t continue. We expect the prices to rise more slowly by the end of 2023, and maybe even drop a little.

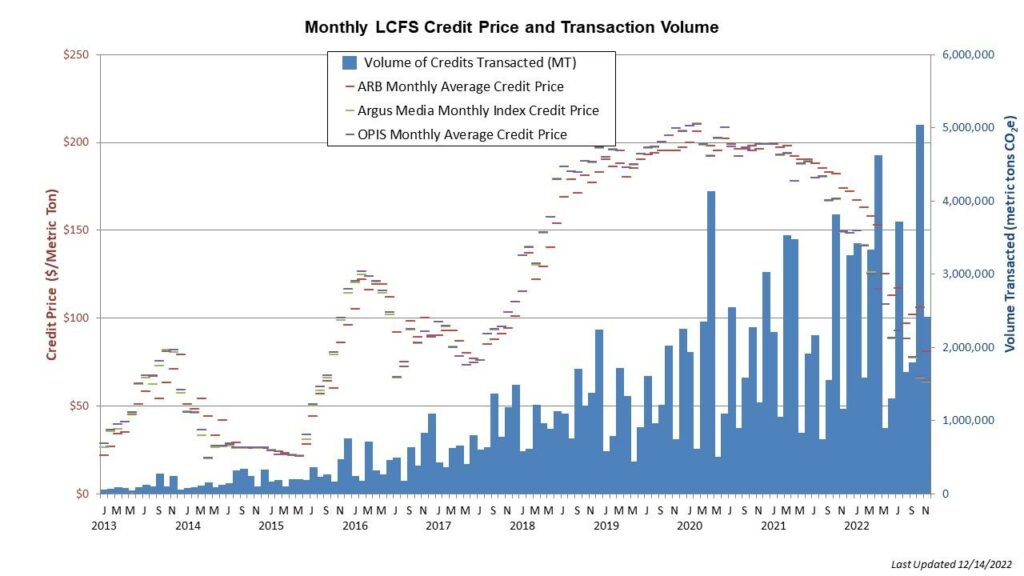

Low Carbon Fuel Standard credit prices will increase but stay below $70 for the year.

These credits are providing strong economic incentives to use non-petroleum fuels and as a result subsidizing the producers of such fuels. In the summer of 2020, the credit prices reached a peak of about $210 per metric ton of fossil CO2 (equivalent) avoided. They have now declined to about $60. These are much higher prices than the carbon allowances from the cap-and-trade program which finished the year around $30 per MT CO2 equivalent, and are creating a powerful incentive to produce alternate fuels. We expect the prices for LCFS credits to go up because each year CARB ratchets down the fuel carbon intensity target, increasing the need for credits and at the same time reducing the quantity. Prices come down when the new supply of alternate fuels exceeds demand. We think we see the supply expanding, so predict that the LCFS credit price will increase only moderately. We have covered how LCFS are driveing emission reductions in California.

Fewer than 10,000 Level 2 Charging Stations will be installed in 2023 in California.

California will struggle to reach its charging station goals. The growth of public and shared charging has been anemic. In January 2021 California had 70,000 public and shared chargers and had 123,000 planned. Of those almost, 6,000 installed and 3,600 planned are DC fast charges. Now, two years later, the state has over 8,500 DC fast chargers and 80,000 total stations. Where are all the level two charging stations we have been predicting? The Cost of Level 2 is too high and most of it is not hardware. To reach California’s 2025 goal of 250,000 stations the CEC has committed to spending $2.9 billion, hoping it will spur 90,000 new EV chargers. $900 Million (plus ~$384M from NEVI) for light duty EV Charging. That works out to about ~$14,000 a charger. Hopefully that will cover it. But for the next year, we predict people fighting over parking spaces and property managers not wanting a headache will hamper California’s goal. (We hope we are wrong.)

Two EV startup companies will be acquired, one by a non-OEM.

In the past two years, there has been an ensemble of Electric Vehicle Manufactures going public on the New York and NASDAQ exchanges. Capital was cheap and everyone wanted to duplicate Tesla’s Stock success. Becoming public was a great option to raise billions needed to deliver EVs. Things have changed but the EV transition is still full steam ahead. Many new EV companies are trading down 80-90%. Being a public company now opens them up to something new. Being acquired. There are several Incumbent OEMs that are behind on the EV transition. Toyota, Mercedes, BMW, Honda, etc. All of the new publicly traded EV companies (with US or European HQs) are now targets for acquisition. And it is not just companies making consumer cars. Both Amazon and Walmart entered into exclusives for delivery vehicles form Rivian and Canoo, whose market cap has been cut in half the last 6 months. Buying a company critical to their distribution at a discount will look very appealing. Small vehicle companies like Arrival SA and Electra Meccanica Vehicles Corp. might be appealing to OEMs like Honda and BMW. With their stock falling and capital cost rising, most of these companies should be eager to accept. Two of the following:

|

Companies that may be acquired |

% from 52 week high |

Approx market cap ($) |

|

Arrival SA |

-97.84% |

<150M |

|

Electra Meccanica Vehicles Corp |

-74.70% |

70M |

|

Polestar |

-60.03% |

11B |

|

Rivian |

-83.84% |

17B |

|

Lucid Group Inc. |

-87.01% |

11B |

|

Fisker Inc |

-62.09% |

2B |

|

Faraday Future Intelligent Electric Inc |

-96.43% |

<150M |

|

Canoo Inc |

-85.04% |

<500M |

|

Nikola Corp |

-81.97% |

1B |

The Sacramento Region will attract a net zero fuel investment >$50 Million.

With the IRA and infrastructure bills, there will be a push for projects that could deliver economies of scale in hydrogen and net zero fuels. With our region’s success with companies and advocacy groups there is a strong possibility of increased investment right here. Sierra Northern Railway has a hydrogen station going in and a hydrogen locomotive, Infinium is doing large projects around the world but operating right here, the California Fuel Cell Partnership has gone international. We believe we will attract enormous investment locally.

Amazon Delivery Vans

By the end of 2022, Rivian finally released more than 1,000 custom electric delivery vans for Amazon. As a startup company, Rivian is looking at major demands from Amazon with their order of 100,000 electric vans by 2030. Rivian will need to make approximately 10,000 vans per year. We believe Rivian still has many obstacles to overcome in such a short time as a new company. They will fall short in 2023, making approximately 4,000 – 6,000 electric vans.

Installed storage capacity in the US will double.

According to Wood Mackenzie, by the end of 2022, the installed capacity of energy storage projects in the US totalled 13.4 GWh, including grid-scale installations and customer-owned projects. In Q3 alone new installations were 4,733 MWh for grid-scale storage and 401 MWh for residential storage projects. We believe that this total capacity will double over the next year, which is less than many analysts forecast. They believe that installations will top 30.3 GWh. We foresee battery production bottlenecks that will restrict the growth.

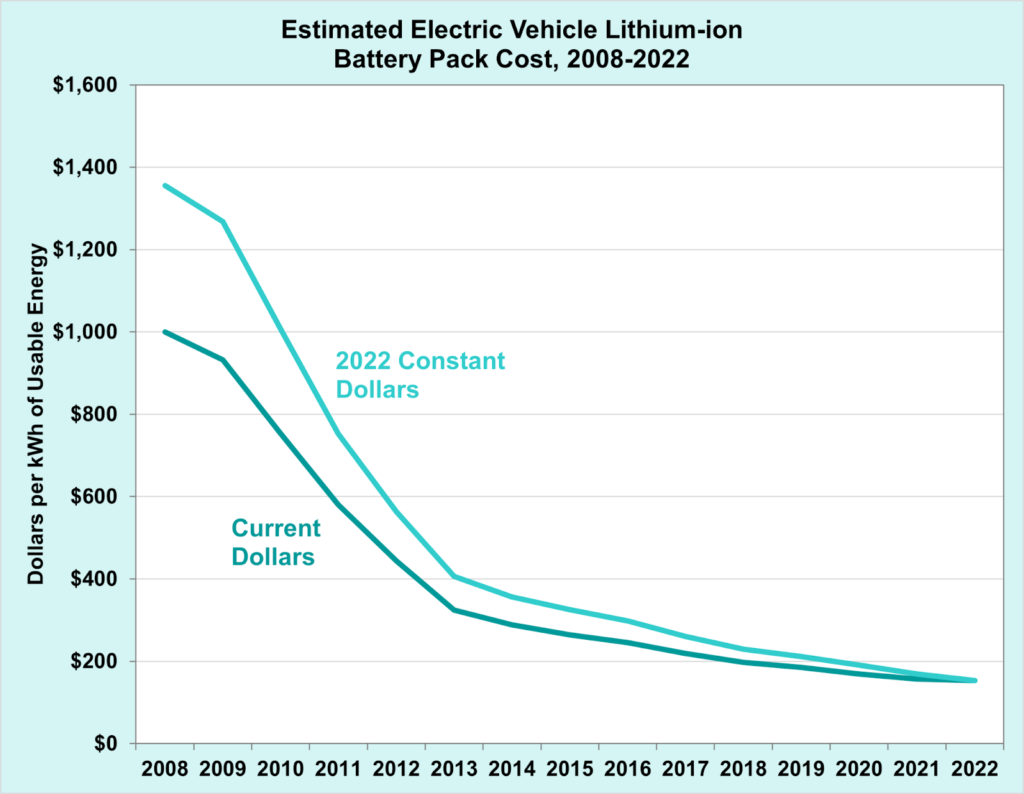

The cost of an electric vehicle battery pack will fall below $140/kWh.

Even in the face of dramatically higher lithium carbonate prices, the prices for a full battery pack have been declining. The Department of Energy’s (DOE’s) Vehicle Technologies Office estimates the cost of an electric vehicle lithium-ion battery pack in 2022 was $153/kWh on a usable-energy basis for production at scale of at least 100,000 units per year. That compares to $1,355/kWh in 2008, a remarkable drop. The decline has been slowing, but we think it will drop another 10% in 2023.

Source: U.S. DOE, Vehicle Technologies Office, using Argonne National Laboratory’s BatPaC: Battery Manufacturing Cost Estimation Tool.

Let’s hope for a great year!

ABOUT THE AUTHOR

Gary Simon is the Chair of CleanStart’s Board. A seasoned energy executive and entrepreneur with 45 years of experience in business, government, and non-profits.

Thomas is the Executive Director of CleanStart. Thomas has a strong background in supporting small businesses, leadership, financial management and is proficient in working with nonprofits. He has a BS in Finance and a BA in Economics from California State University, Chico. Thomas has a passion for sustainability and a commitment to supporting non-profits in the region.

CleanStart Sponsors

Weintraub | Tobin, BlueTech Valley, Revrnt, River City Bank

Moss Adams, PowerSoft.biz, Greenberg Traurig, California Mobility Center