2023 Predictions Recap

Last year we looked to make bolder predictions, many around falling prices. Well, some predictions were right, others were wrong. There was good news from Rivian and vigorous growth in battery deployment, keeping prices high. The PPA price wars came to an end as demand for clean energy rose and supply chains increased costs. Overall we are saying we went 4 for 10.

You can read the prediction post here.

There will be no Level 3 Energy Emergency Alerts in California this year.

There were no Stage 3 alerts this year. There were no Stage 2 and only one Stage 1 alerts this year (to date). So…bullseye!

Lithium prices will decline and finish the year below $40,000 per MT.

Bingo! Lithium carbonate plunged since the beginning of the year, now sitting under $20,000 per MT. That’s a drop of 73%. At the same time, cobalt prices dropped 36%. Cobalt is another common ingredient in lithium-ion batteries. Interestingly, nickel prices dropped 42% to $17,421/ton, so lithium is not much more expensive than a common commodity metal also used in batteries. For comparison, copper is priced at about $8,265/ton (up from its low of $1,300/MT or $0.63/lb 25 years ago). Some analysts forecast the price of lithium will double in 2024, but we are skeptical of such a big hike in the face of several large new mines opening up.

Private, pulsed-fusion company Helion will announce reaching significant milestones.

Nope. Helion did not announce reaching any new technological milestones that would trigger investors to put in more money. However, they did sign an agreement with Microsoft to begin providing 50 MW of power by 2028. Because the agreement is made through Constellation Energy, we guess that if the plant is not ready by 2028, Constellation will provide zero carbon power to Microsoft in another way. However, if HeLion meets the 2028 deadline, it will likely beat the Small Modular Reactor projects to the finish line in a test of fusion vs. fission. The slipping deadline with the SMRs has recently been in the news as the leading SMR developer NuScale has had to suspend its pioneer project in Idaho because its intended power purchasers were not willing to pay the price for the power that would make the project viable, even with heavy subsidies from the DOE. In addition, in 2023 both HeLion and our second contender, HB 11 Energy, received small contracts from DOE to continue their work. A third challenger of note in this race is TAE Technologies in Southern California aiming at the same Proton-Boron fusion reaction, but using pulsed accelerator beams to drive the reaction instead of pulsed lasers.

Regardless of the slower-than-expected advances with any of these technologies, the opportunity they offer to bypass the building of more fission reactors with their enormous waste disposal issues makes them important. We still like the underdogs.

Power Purchase Agreement pricing on average for either solar or wind will not exceed $50/MWh.

Oops. Both solar and wind projects broke the $50 barrier. We underestimated the impact of higher inflation and the demand pressure on 3Q23 blended prices solar and wind prices. According to recent surveys by Level Ten Energy, these blended prices rose to $54.90/MWh, with wind at about $57.50/MWh and solar at about $51/MWh. It looks like they will continue to rise into 2024.

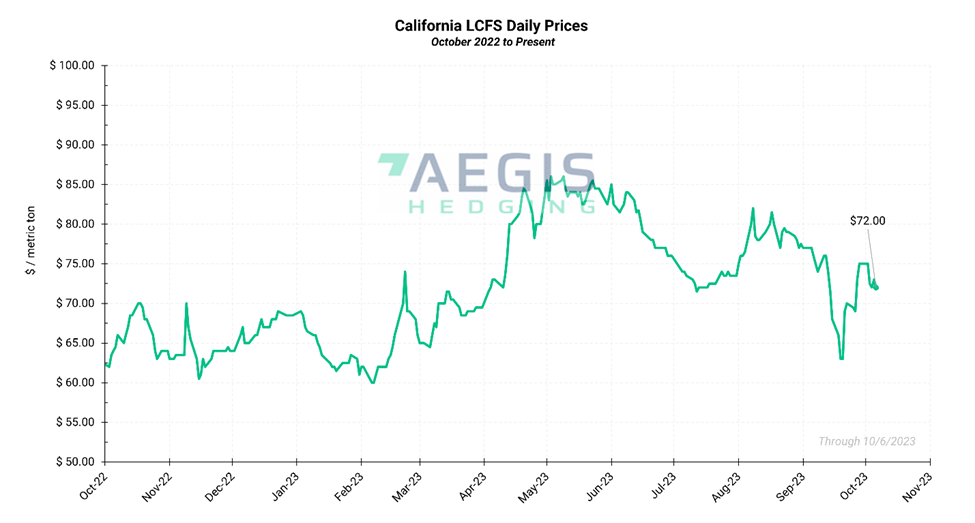

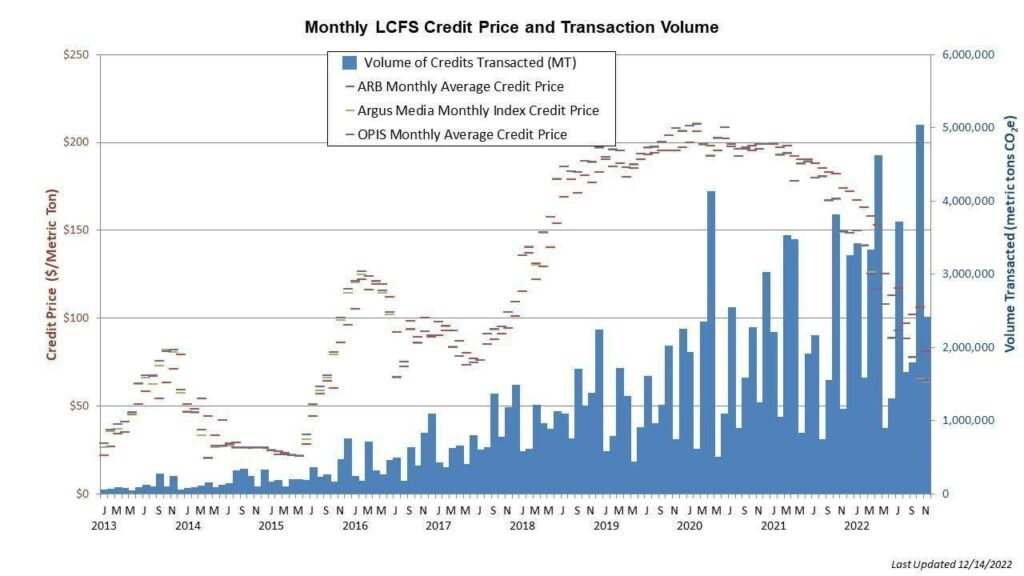

Low Carbon Fuel Standard credit prices will increase but stay below $70 for the year.

Wrong. Prices drifted up to near $90/ton but then came back under $75. The average for the full year is not yet available, but it looks like it will be near $80. At the same time, the price of a carbon credit in ARB’s Cap and Trade market rose to $39/ton. Selling credits is becoming more lucrative, with the LCFS credits about double the value of the cap-and-trade variety. .[We can include the following chart if useful.]

Fewer than 10,000 Level 2 Charging Stations will be installed in 2023 in California.

Sadly, this one was right. Q4 2022 had 78500 Shared and Private Level 2s installed. As of September 12, 2023 (The CEC’s last update) there are 83,597 Shared and Private Level 2s. Just over 5000 were installed. We will keep our eyes open if a more recent update comes out. On a positive note, California now has over 10,000 DC Fast Chargers. Gary and Thomas will have to revisit their debate between level 2 and DC Fast Charging.

Two EV startup companies will be acquired, one by a non-OEM.

Complete miss. We reached out of the box on this one predicting consolidation. We thought lagging OEMs would pick up a public company. OEMs like Mercedes have record years selling electric vehicles. Others like Toyota heavily invested in supply chains needed for Electric Vehicles. None have acquired one of the listed companies. But it could happen… Only Rivian showed a significant improvement in its market cap.

|

Approx Market Cap ($) |

|||

|

Company we predicted |

Last Year |

Around Now |

Acquired |

|

Arrival SA |

<150M |

25M |

No |

|

Electra Meccanica Vehicles Corp |

70M |

44M |

No |

|

Rivian |

17B |

21.7B |

No |

|

Lucid Group Inc. |

11B |

11B |

No |

|

Fisker Inc |

2B |

555M |

No |

|

Faraday Future Intelligent Electric Inc |

<150M |

15M |

No |

|

Canoo Inc |

<500M |

205M |

No |

|

Nikola Corp |

1B |

1B |

No |

The Sacramento Region will attract a net zero fuel investment of>$50 Million.

It happened! Right before we published, Infinium announced $75 Million from Breakthrough Energy Ventures!

Rivian struggles to make Amazon 10,000 Deliveries

Rivian did something none of the similar EV startups did. Beat predictions. In October, they announced Amazon had 10,000 Rivian delivery vans in service. With their exclusive Amazon deal ending, they have already signed additional fleet deals. Additionally, they have continually upped delivery predictions and through Q3 have sold more than double the Trucks and Vans as Ford and is the only company in our EV acquisition prediction to increase its market cap significantly.

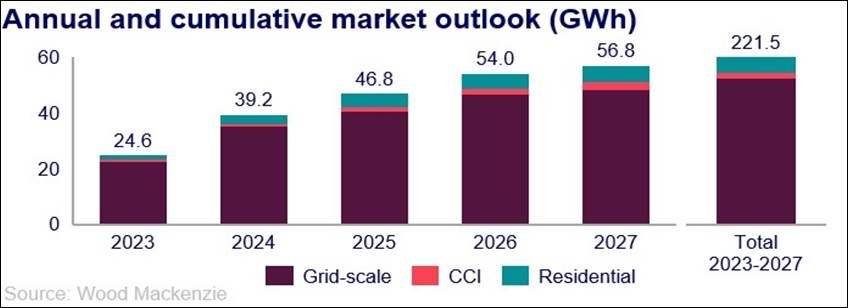

Installed storage capacity in the US will double.

Close one. Wood Mackenzie estimates that total installed storage capacity in the US will be 24.6 GWh in 2023, a tiny bit below a doubling from 13.4 GWh. However, we were correct that the original forecast of 30.3 GWh of storage capacity would turn out to be too high.

In California in October, the Governor issued a statement that the state now had over 6600 MW of installed battery capacity. a tenfold increase in five years, That would also mean it had about 16.2 GWh energy storage capacity.

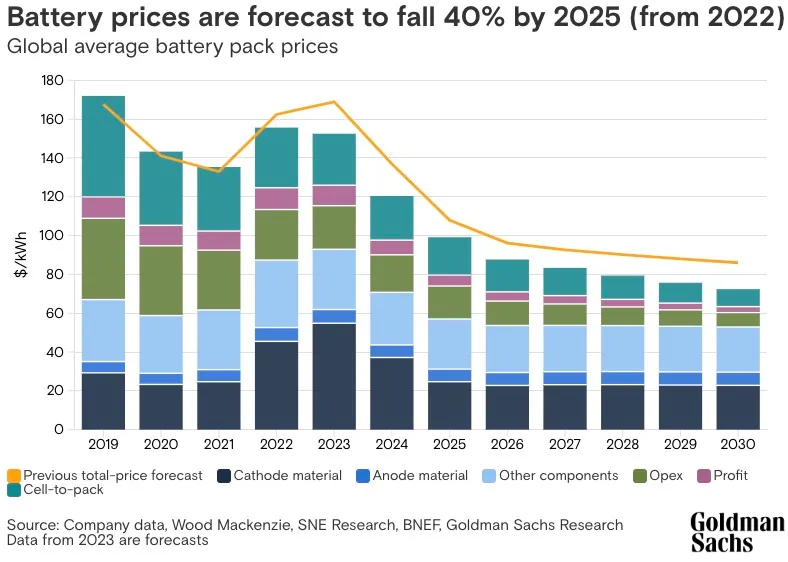

The cost of an electric vehicle battery pack will fall below $140/kWh.

Not sure. The DOE has not published its new estimates for 2023 yet. A Goldman Sachs report provides information that indicates a modest decline in 2023 (but not below $140/kWh), with a more significant decline coming in 2024 as the lower prices for lithium, cobalt, and nickel impact costs.

ABOUT THE AUTHOR

Thomas is the Executive Director of CleanStart. Thomas has a strong background in supporting small businesses, leadership, financial management and is proficient in working with nonprofits. He has a BS in Finance and a BA in Economics from California State University, Chico. Thomas has a passion for sustainability and a commitment to supporting non-profits in the region.

Sponsors

Weintraub | Tobin, Revrnt, Moss Adams, PowerSoft.biz, Greenberg Traurig