Once again we gazed into our crystal ball and came up with more predictions for the coming year–this time we have eleven. Will higher utility rates let the rooftop solar industry bounce back? Will new EV prices drop? Will Texas overtake California as the leader in total solar installations? Will there be a big jump in investments in turning captured carbon dioxide into fuels and chemicals? Will we see over $150 million in investments in clean tech companies in the region? We stick our necks out on these and other forecasts.

Looking back at how we did last year, we were right on 4 out of 10, and pretty close on one. We have done much better in earlier years, but we took some bigger swings with last year’s ten.

Have some thoughts on what we say? Take a look. Let’s hear what you think.

Higher PG&E Rates Will Open New Opportunities For Rooftop Solar to Rebound

PG&E has some of the most complicated rates in the country and in 2024 it will have the highest prices for electricity in California and one of the highest in the nation. The average homeowner bill will increase by $33 per month now but could increase by as much as $100 by next year following two more expected rate hikes. These hikes are the result of the recovery of court-ordered costs for damages from fires for which PG&E has been judged largely responsible as well as new costs for making power lines safer as mandated by the CPUC.

The new rates will shock the system in two ways. First is the sheer magnitude of the total rate. PG&E’s average rate in 2013 was about 18 cents per kWh. With just the January hike, residential rates will likely average over 45 cents/kWh, with rates over 60 cents for certain times (it’s complicated). With the CPUC likely to approve more cost recovery, the rates seem sure to exceed 55 cents on average. Any way one looks at it, the rates are tripling.

The second shock is that a growing fraction of a customer’s bill can’t be reduced by trimming usage. If customers were charged just by their usage, the rates would give most customers the incentive to switch to alternative power sources or to conserve. To avoid this outcome in part, the alternative PG&E and other utilities in the state proposed was to push up the part of rates that are a fixed amount per month regardless of use, while lowering the price per kWh. Typically, fixed monthly charges were a few dollars per month. The new rates boost that to about $19/month. But it doesn’t stop there. A new rate proposal would take this much farther, tying the charge to the income level of the customer. Under the joint utility plan, PG&E households with annual incomes between $28,000 and $69,000 would pay $30 per month in fixed charges. Those earning between $69,000 and $180,000 would pay $51, and those earning more than $180,000 would pay $92. Low-income customers whose annual earnings are at or below the federal poverty level (FPL) would pay $15 per month in fixed fees. Currently, the average total household electric bill in California is $164 a month. The new monthly fixed charge would average $53, and there would be a 12-cent drop in the price per kWh to about 34 cents. Some green advocates like this option because it would encourage more conversion from gas to electricity and avoid carbon emissions.

When additional rate hikes are approved, look for a disproportionate increase in the fixed monthly fees.

Seeing these conditions, innovators will begin to respond in 2024. We don’t expect anything major at first, but a lot of new ideas will begin to bubble up. Here’s what to watch for.

- A reinvigoration of solar rooftop sales with the increased savings from avoiding the higher prices. Solar installations declined precipitously after the CPUC order to cut the price utilities paid for surplus generation (the NEM 3.0 rate). The higher rates now and later in the year may provide enough incentive to avoid purchases from PG&E that the market could rebound.

- A push to include storage and load management options along with solar to avoid the priciest part of the day when a kWh may cost over 60 cents and enhance the gains to customers.

- More sales of storage to existing solar customers who would benefit from using their surplus daytime power production rather than selling it to the utility at the new low NEM 3.0 buyback rates

- New communities of several thousand homes want to have their own community utility company as a co-operative, a different kind of CCA, or a microgrid, some of which may require changes to the law. There could be new legislation introduced to remove some of the barriers to communities doing that. The legislation will probably not be successful in 2024, but could well come back later.

- High-capacity EV charging stations for heavy-duty vehicles are being powered independently from the grid to avoid big fixed charges as well as the per kWh prices.

Texas Will Make New Solar Installations Twice As Fast As California

California has been the reigning champ of utility-scale solar forever. Now late-bloomer Texas has been on a tear, while additions in California have grown only slowly. The result is that Texas is now the leader in this sector.

| MW Utility-Scale Solar | 2020 | 2021 | 2022 | 2023 |

| California | 14.47 | 15.45 | 15.97 | 17.28 |

| Texas | 4.88 | 8.84 | 14.81 | 18.36 |

Data from Canary Media referencing EIA, ERCOT, and CAISO

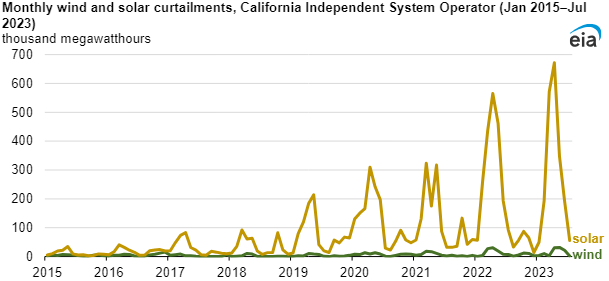

A big reason for the moderation in new utility-scale solar in California is the growing amount of the output from those systems being curtailed when output at peak times exceeds the need. Over time, transmission expansions and additions of storage will reduce the curtailments, but until then it is hard to see much more solar being added.

In the non-utility sector, it is a different story, and California retains its leadership over second-place Texas and third-place Florida in total MW installed.

| Total Solar Installed | MW | # of Installations | Avg. kW/installation |

| California | 43,244 | 1,928,662 | 22.4 |

| Texas | 20,028 | 264,493 | 76.4 |

| Florida | 12,877 | 211, 551 | 60.9 |

Source: Wood Mackenzie/SEIA report data

We expect Texas will install new solar in total at twice the pace of California in the coming year which may lead to California losing its overall leadership in five years. The tide will shift in favor of California if the new utility rates in the state stimulate more non-utility additions.

The Installed Costs of Residential Solar Will Decline Once Again

After steadily declining up to 2019, the installed cost of residential solar systems less than 10 kW began to climb. We expect better news in 2024 with the costs again declining, but only slightly.

| $ Cost/kW | 2015 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Home solar <10 kW | 5.49 | 4.56 | 4.50 | 4.61 | 4.60 | 4.74 | 4.79 |

Source: https://www.californiadgstats.ca.gov/charts/

Nationwide There Will Be Over $250 Million in Investment in Carbon Dioxide Utilization Projects, Creating Significant Amounts of Renewable Fuels And Chemicals

The realization will grow that carbon is not the enemy, but digging up and releasing fossil carbon is the real problem. After all, every one of us and every animal on earth exhales carbon dioxide and has done so for millions of years. If carbon dioxide emissions were recycled into conventional fuels like diesel, gasoline, and jet fuel, it would solve several problems: It would yield products that are easy to store, easy to blend into existing stocks of conventional fuels and chemicals derived from oil without the need for all new infrastructure. It would be the need to dig up fossil carbon stores in the form of coal, oil, and natural gas and release that new stored carbon into the air. As a result, it could hasten the switch away from conventional fuels, faster than could be done with the substitution of electricity and hydrogen for those fuels. The key is how quickly the recycled carbon fuels can be made economical.

Local company Infinium is a pioneer in making recovered carbon dioxide into new fuels, focusing on creating Sustainable Aviation Fuel or SAF. It’s a huge market and many companies are pursuing it.

However, this will not diminish the need for carbon-negative projects to reduce the concentration of carbon dioxide in the atmosphere. And that’s another story.

Two More High-Power EV Charging Stations Will Begin To Be Built in The Region With Capacities Over 10 MW

There is already one of these being built near the Sacramento Airport. These stations will primarily serve the heavy-duty trucking fleets being mandated by the ARB and will likely be near the major interstate highways. They will combine solar, wind, and battery storage, but minimize their draw on the power grid to avoid the new high fixed monthly fees as much as possible. They could also involve backup engine generators running on renewable fuels.

New Investments in Clean Tech Companies in The Region Will Top $150 Million

The total investments in 2023 were well over $100 million. (We will report more exact figures soon once all the data are in.) We believe the momentum will continue. Another company going public like Origin Materials did in 2020 would put that way over $150 million, but we don’t think that will happen.

A Third Long-Duration Energy Storage Project Will Be Launched in Northern California

There are already two. One 5 MW system is being pursued by Form Energy with its iron-based battery and funded by the CEC to be installed in Mendocino County. The other is SMUD’s iron redox flow battery system from Energy Storage System which will add 4 MW initially, with potential expansion to 200 MW. However, the interest is high in getting even more underway to meet the state goal of having 4,000 MW of long-duration storage. We think another group will launch a third MW-scale project this year. It could use batteries, but it could also involve some different technology like cycling supercritical carbon dioxide.

California will continue to add to its 6,600 MW of shorter duration, grid-scale battery energy storage projects as well, but the new focus is on the long-duration, lower cost systems to provide another layer of backup.

The Value Of an Offset Ton of Carbon Dioxide in California Markets Will Increase Slowly

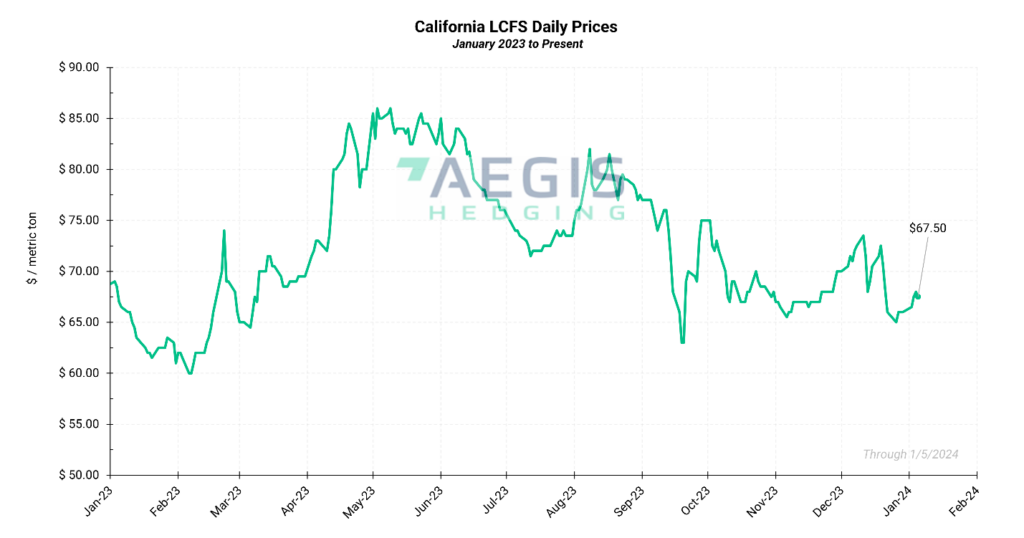

The upward trend is a relatively new feature. Offset from the cap-and-trade program stayed below $20 per ton for years, and then moved up to $43 last year. [Waiting for latest data] LCFS credits have been much higher for a ton of carbon dioxide, ending the year at $67 after hitting $86. We expect the differential to remain and the price of the credits to continue a slow rise to $72. The price for LCFS credits in Oregon has been above $95. The credits are not transferable between the states, so that differential may remain.

The Year of the USED Electric Car

We have made predictions about electric cars in the past. This year we predict growth in the secondary market. With fleet electric vehicles turning over and over 4.7 Million EVs (plug-in hybrid electric and full electric) sold cumulatively, we expect to see the secondhand market take off this year. This might be a gimme based on Hertz’s recent liquidation of its Tesla. There still is a big bottleneck to secondhand EV adoption though… and that is the ability to repair them.

Commitments to the First Small (less than 20 MW) Offshore Wind Deployments Will Be Made for a Site Off the North Coast

California policy favors some big wind farms offshore in the next two decades. Conventional wisdom is that any offshore wind farms will involve massive 20+ MW floating platforms with towers over 500 feet tall and that the first deployment will be in Central California. We have a different view. We think the first mover will be something smaller and much farther north. It will lead to the deployment of hundreds of smaller, cheaper floating wind turbines.

The EV Premium Disappears

By some estimates, new EV prices dropped by a 3rd in 2023. Some of this was because of cheaper options entering the market, used options, price slashing of existing EVs, and supply chains untangling. Per Kelley Blue Book, EV prices fell 20%. We expect this trend to continue, though not as significant, with EV prices falling by less than 10%.

ABOUT THE AUTHOR

Thomas is the Executive Director of CleanStart. Thomas has a strong background in supporting small businesses, leadership, financial management and is proficient in working with nonprofits. He has a BS in Finance and a BA in Economics from California State University, Chico. Thomas has a passion for sustainability and a commitment to supporting non-profits in the region.

Sponsors

Weintraub | Tobin, Revrnt, Moss Adams, PowerSoft.biz, Greenberg Traurig